SUPPLY CHAIN FINANCING

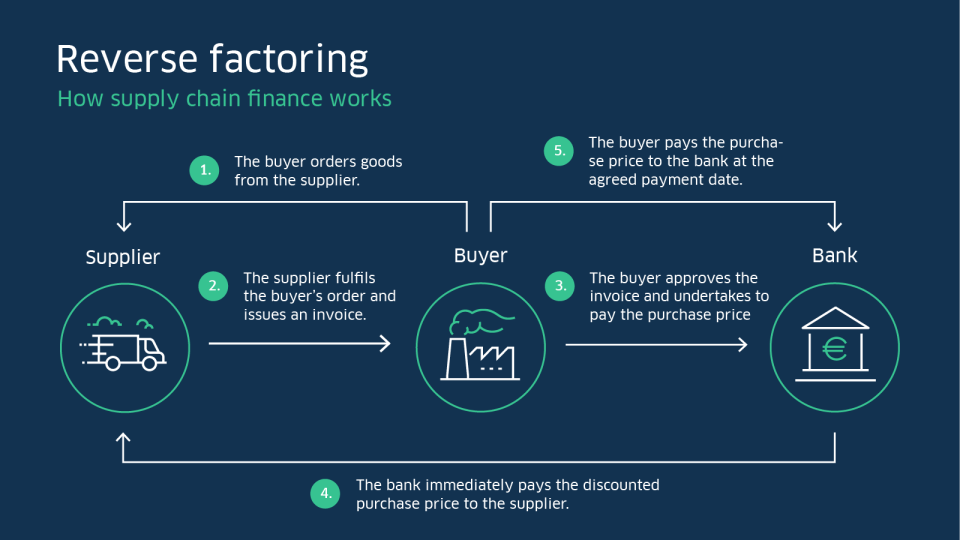

Supply chain financing, also known as supplier finance or reverse factoring, is a financial strategy that allows our clients to improve their cash flow by optimizing their supply chain operations. This involves using our financial network infrastructures to provide early payment to our client’s suppliers in exchange for a discount on the invoice amount.

In a typical supply chain financing arrangement, EquipUp arranges for our financial institution to pay our client’s supplier early, often within a few days of invoicing, in exchange for a discount on the invoice amount. The financial institution collects the full invoice amount from our customers later, typically when the invoice is due.

Our Supply chain financing can benefit both you and your suppliers. For our clients, supply chain financing can help improve cash flow by extending payment terms and reducing the need for working capital. For our client’s suppliers, supply chain financing can provide access to low-cost funding and help improve cash flow by delivering early payment on invoices.

In addition to improving cash flow, EquipUP’s supply chain financing model also helps strengthen relationships between our clients and suppliers by providing a more predictable and stable funding source. By delivering early payment on invoices, our clients help suppliers manage their cash flow and reduce their exposure to financial risks.

Overall, EquipUp’s supply chain financing is a valuable strategy for our customers looking to optimize their supply chain operations and improve cash flow by working closely with their suppliers and our financial partners.

Equipment Financing

We can fund a large domestic or international business opportunity that traditional financing companies will not approve. Since 2002, our experts have secured over $750 million to help businesses to grow throughout the US, UK, Canada & China. If you’re a re-seller or distributor of hard goods with a purchase order that you cannot fulfill due to insufficient capital, we can help.

The confidence to fulfill your biggest orders

Using purchase order financing gives you the ability to fulfill all your sales orders, even those that exceed your norm in volume or scope. 100% financing of your supplier costs frees up your cash for critical business expenses allowing you to deliver bigger orders. All you need is a PO from a credit worthy commercial or government client to get started.

With PO financing, you can:

Minimize capital constraints by letting us fund it for you

Minimize capital constraints by letting us fund it for you Grow your business now and pave the way for more

Grow your business now and pave the way for more Improve your competitive edge among customers and suppliers

Improve your competitive edge among customers and suppliers

The bank said no – why will we say yes?

While a bank looks at your company’s finances, we look at those of your customers. Whether a start up, small business or large enterprise, if you sell products to large companies or government concerns, we can fund it for you in expectation of your future profit. It’s a great way to get the working capital you need, in a matter of weeks.

Why EquipUp?

Up to 100% financing for $500K – $25 million

Up to 100% financing for $500K – $25 million Fast approval and turnaround so you can get to work quickly

Fast approval and turnaround so you can get to work quickly We’ll work with your existing credit institutions

We’ll work with your existing credit institutions Proven track record in invoice factoring & financing purchase orders plus other creative financial solutions for those who may not qualify

Proven track record in invoice factoring & financing purchase orders plus other creative financial solutions for those who may not qualify